When Ford introduced the F-150 Lightning last week — an electric version of the best-selling vehicle in the U.S. — it marked a significant milestone in the brief history of electric vehicles. The truck boasts 530 horsepower and weighs 6,500 pounds, with a price tag just under $40,000 ($32,474 after a federal tax credit), prompting comparisons to Ford’s Model T, which is known for making automobiles affordable for the middle class. Within the first 48 hours of its launch, Ford recorded nearly 45,000 pre-orders for this battery-powered giant, which is about 20 percent of all EVs registered in the U.S. last year.

The F-150 Lightning, alongside the multitude of electric vehicle models major automakers are set to release in the coming years, indicates that the electric vehicle revolution is becoming mainstream. However, as this industry—crucial for addressing climate change—develops, a new challenge is arising: securing the necessary minerals for EV batteries.

Lithium, nickel, cobalt, and copper used in these batteries were all once extracted from the earth. Currently, much of this mining occurs in countries such as Russia, Indonesia, and the Democratic Republic of Congo, regions where environmental regulations are often inadequate, labor standards are frequently low, and the mining sector has a history of causing conflicts with local populations. With projections that the number of electric vehicles on the road will grow from 10 million in 2020 to around 145 million by 2030, the demand for battery minerals is set to increase considerably. Some industry observers caution that the surge in clean transportation could lead to a rise in harmful mining practices.

To minimize the necessity for new mining, specialists argue that we need to improve recycling processes for electric vehicle batteries once they reach the end of their life. While only a limited number of EV batteries have currently aged out, it is expected that millions of tons will be decommissioned in the following decades. These batteries could provide a substantial portion of the future mineral requirements for the EV industry—but it is essential to develop better recycling techniques and supportive government policies to prevent these batteries from ending up in landfills.

Payal Sampat, the Mining Programs director at the environmental nonprofit Earthworks, states, “The approach taken has flipped to view this as an immediate concern: ‘We need to tackle these climate challenges, so let’s quickly establish new mines and extract resources.’ This reflects the mindset of short-term planning. However, we must develop thoughtful, long-term solutions to this issue.”

Understanding a battery’s components

Electric vehicle batteries are intricate technologies, but in a fundamental sense, they resemble the lithium-ion battery found in mobile phones. Each battery cell comprises a metal cathode (which is made of lithium and a blend of other materials that can include cobalt, nickel, manganese, and iron), a graphite anode, a separator, and a liquid electrolyte usually made of a lithium salt. As charged lithium ions travel from the anode to the cathode, they generate an electrical current.

One battery alone can power a phone. To power a vehicle, thousands of cells need to be bundled together—generally arranged in a series of modules, which are interconnected into battery packs contained within a protective metal enclosure. Collectively, these large electrochemical constructs can weigh over a thousand pounds (the Lightning battery reportedly weighs closer to 2,000 pounds).

Most of the valuable materials that recyclers aim to retrieve are located within the individual battery cells. However, electric vehicle batteries are engineered to endure many years and numerous miles of operation, rather than to be easily dismantled into their individual components. “For various valid reasons, you wouldn’t want them to disassemble easily,” comments Paul Andersen, the principal investigator for the Faraday Institution’s Reuse and Recycling of Lithium-Ion Batteries (ReLib) project at the University of Birmingham in the U.K.

Due in part to the expense and intricacy associated with dismantling EV batteries, present recycling methods are relatively rudimentary. Once the battery is depleted and the robust outer shell is removed, modules are typically shredded and placed in a furnace. Lighter materials such as lithium and manganese are combusted, resulting in an alloy slurry that includes higher-value metals like copper, nickel, and cobalt. These individual metals can then be extracted from that alloy using strong acids. These methods, known as pyro- and hydrometallurgical recovery, consume significant amounts of energy and produce toxic gases and waste, which need to be captured.

While cobalt and nickel can typically be recovered at high efficiency, lithium often lacks sufficient value for recyclers to pursue its recycling. When lithium is retrieved, it is frequently not of a quality adequate for the production of new batteries.

In the future, there might be a cleaner and more effective alternative: direct recycling, which involves extracting the cathode material from individual battery cells and revitalizing the chemical mixtures, including reintroducing lithium that has been consumed during usage, rather than isolating individual metals from the blend. Although direct recycling techniques are still in their nascent development phase, this method could potentially enable recyclers to recover a greater amount of materials from batteries and yield a higher-value final product, according to Gavin Harper, a research fellow at the Faraday Institution.

“There’s inherent value in the raw materials, but even greater value exists in how those materials are combined,” Harper states. “Achieving this would be the ideal goal of recycling—to preserve the value found in the structure itself, aside from just the materials.”

Growing an industry

The International Energy Agency (IEA) estimates that the global capacity to recycle dead electric vehicle (EV) batteries currently stands at 180,000 metric tons annually. In comparison, all EVs introduced in 2019 will ultimately produce 500,000 metric tons of battery waste.

And that’s just a single year’s worth. By 2040, the IEA anticipates there may be 1,300 gigawatt hours of used batteries requiring recycling. To express this in weight, Harper mentions that an 80-kilowatt-hour battery pack from a Tesla Model 3 weighs slightly over a thousand pounds. If all of these expired batteries originated from Tesla Model 3s, this quantity of spent battery capacity translates to nearly 8 million metric tons of battery waste—which Harper points out is 1.3 times the weight of the Great Pyramid of Giza.

If recycling can be expanded, this waste could serve as a major source of minerals. In a sustainable development scenario where the EV sector grows at a rate consistent with keeping global warming below 3.6 degrees Fahrenheit (2 degrees Celsius), the IEA suggests that recycling could satisfy up to 12 percent of the minerals required by the EV industry by 2040. However, if this same climate scenario is combined with a more optimistic perspective on recycling, it could potentially have a significantly larger impact.

A recent study commissioned by Earthworks found that if we assume all dead EV batteries are collected for recycling, along with high mineral recovery rates—especially for lithium—recycling could fulfill as much as 25 percent of the EV industry’s lithium requirements and 35 percent of its cobalt and nickel demands by 2040.

These projections are “not meant to forecast the future,” wrote report co-author Nick Florin, a research director at the University of Technology Sydney, in an email. “We present a possible future to highlight how crucial recycling could be as a key strategy to reduce the need for new mining.”

To unlock this potential, Florin and his colleagues stress the importance of strong government policies to support EV battery recycling. Such measures could include standards for battery design that make disassembly easier for recyclers, battery take-back programs, laws prohibiting landfilling, and regulations that facilitate the transport of hazardous battery waste across regions for recycling.

The European Union already has regulations in place regarding EV battery disposal under an “extended producer responsibility” framework and is updating its policies to define specific targets for mineral recovery. However, only three states in the U.S. have extended producer responsibility mandates that require lithium-ion battery manufacturers to address their waste.

“Shifting the responsibility for ensuring batteries are collected at the end of their lifecycle to the market operators is a clear policy solution,” remarks Benjamin Hitchcock Auciello, coordinator of Earthworks’ Making Clean Energy Clean, Just and Equitable program.

Recycling alone will not suffice to satisfy all, or even the majority, of the demand for battery metals as the industry undergoes rapid expansion. Thea Riofrancos, a political scientist at Providence College in Rhode Island who researches resource extraction and green technology, considers recycling to be “one approach among several” to diminish the need for new mining. Other methods could entail creating newer batteries that utilize fewer minerals and enhancing public transportation, along with developing walkable and bike-friendly cities to lessen the overall demand for personal vehicles.

Nonetheless, even if recycling only addresses one-quarter to one-third of our battery mineral demand in the forthcoming decades, Riofrancos believes it is still a critical area to focus on since it encourages us to “reassess our relationship with technology.”

“Recycling prompts us to acknowledge that there are biophysical limits,” Riofrancos states. “These are finite resources in the end. We should treat these as items we wish to maximize utility from rather than as resources we remove from the earth and subsequently discard.”

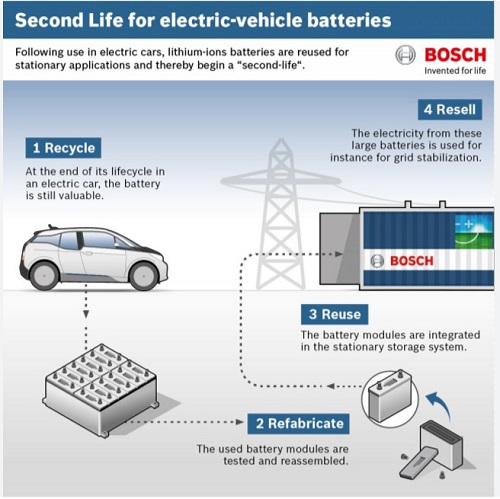

Second Life for Old Electric

Envision a future where used electric vehicle batteries are utilized in communities as energy-storage systems that act as a safeguard against power failures, while facilitating the adoption of solar and wind energy—and increasing electric car usage. This concept has advanced with the demonstration of a compact unit made from repurposed Chevy Volt batteries capable of supplying enough electricity to power between three to five typical American households for a maximum of two hours.

Created by General Motors and ABB, one of the largest electrical technology firms globally, this device comprises five lithium-ion battery packs from plug-in hybrid Volt models, interconnected in a new configuration and cooled by air rather than the liquid used in their previous automotive applications. Although these batteries have degraded to below acceptable performance levels for vehicles, the companies assert that they have sufficient capacity to support the grid for at least ten years within this community energy storage unit.

“In a vehicle, instant power and a substantial amount of it are essential,” explained Alexandra Goodson, who is the business development manager for energy storage modules at ABB. However, numerous grid storage applications require a slower, more sustained energy delivery. “We are discharging for two hours instead of providing immediate acceleration,” she noted. “This is far less taxing on the system.”

The Path to Renewables

The collaborators had previously showcased the technology in a laboratory setting. Now, Pablo Valencia, senior manager of battery lifecycle management at GM, stated, “It has become a reality,” during a presentation in Sausalito, California, where GM established a demo unit about the size of several refrigerators to power video, lighting, and sound in an outdoor setting. “This is a groundbreaking achievement, being able to utilize secondary automotive batteries for a grid-based function,” Valencia remarked.

To evaluate the refurbished Volt batteries in a real-world scenario, their partner Duke Energy, the leading utility company in the United States, intends to install this unit next year in proximity to a transformer. “We’ll conduct tests for as long as necessary to demonstrate all the benefits,” stated Dan Sowder, senior project manager for new technology at Duke.

Installed on the grid, community energy storage systems could assist utilities in integrating highly variable and occasionally unpredictable renewable sources such as solar and wind energy into the power supply while also accommodating surges in demand from electric vehicle charging.

“Managing wind energy presents significant challenges for grid operators,” mentioned Britta Gross, director of global energy systems and infrastructure commercialization for GM. “It’s inconsistent; sometimes it doesn’t blow for days. Managing that is exceedingly labor-intensive.” Sowder, whose company services 7.1 million customers in the Midwest and Southeast U.S., explained, “Our grid, like most electrical grids, is not designed to cope with that level of rapid fluctuations. Storage can help smooth out these issues.” Achieving stable delivery of renewable energy has been a significant research focus for ABB, located in Zurich, Switzerland, which is the largest provider of electrical equipment to the wind power sector.

On the demand side, utility companies are facing potential enormous spikes in energy usage from electric vehicles, which represent “probably the largest electrical load introduced to a residential environment in the last five decades,” according to Scott Hinson, director of the Pike Powers Commercialization Lab in Austin, Texas.

“This is somewhat concerning for a grid that was never designed to accommodate such loads,” added Sowder. Community energy storage systems can be charged during periods when, for example, wind energy is abundant overnight and demand is low, allowing them to deliver energy when required. “This means potentially fewer infrastructure upgrades are necessary to support electric vehicle charging.”

Pursuing Grid Solutions

GM is not the only automobile manufacturer aiming to establish a secondary market for its electric car batteries. Earlier this year, Nissan North America partnered with ABB, 4R Energy, and Sumitomo Corporation of America to announce their intention to construct a prototype for a grid storage system utilizing Nissan Leaf batteries.

Ultimately, if the battery—the most costly component of an electric vehicle—continues to have value beyond its operational life in the car, Valencia noted, “It supports residual values.” This term refers to how much a vehicle is worth at the conclusion of its lease or its useful life, which is a crucial factor in determining lease rates and resale values. Consequently, he stated, “We’re assisting the first customer.”

“If a market emerges for the recycling of spent batteries in stationary power applications, consumers might see this as a small increase in the resale value at the end of the battery’s lifecycle,” stated Kevin See, an analyst from Lux Research.

Naturally, since electric vehicles such as the Volt and the Leaf are relatively new to the marketplace, a significant amount of spent electric-car batteries won’t be available for some time. These batteries are designed to last up to ten years in vehicles. For their demonstration unit, GM sourced batteries degraded through simulations from their own lab facilities.

The demo unit’s batteries had been reduced to approximately 85 or 90 percent of their original capacity, according to Valencia. “We reached out to everyone, requesting their oldest batteries,” he mentioned. However, GM anticipates that as old batteries become available, they will be located and acquired for grid-storage applications through a system similar to the current auction process for components like water pumps and starters at the end of a vehicle’s lifecycle for recycling or refurbishment. Before a vehicle is decommissioned, its identification number is scanned to generate a list of in-demand “core” components.

Integrating lithium-ion batteries from electric vehicles complicates the design of energy storage systems for the power grid, though. “It is necessary to adapt a battery that was specifically designed for use in a constrained, mobile environment in cars,” See explained. Additionally, the required modifications differ based on the type of vehicle. “A fully electric vehicle battery is built to store maximum energy, while a hybrid’s is optimized for a higher power-to-energy ratio.” Ultimately, he added, this increased complexity “could lead to higher costs associated with modifying these systems for a completely different use than they were originally intended for.”

Spent electric vehicle batteries encounter stiff competition from new lithium-ion batteries specifically engineered for grid applications, according to See, as well as alternative options like flow batteries and molten salt batteries, which may be less expensive. “There is and will continue to be an abundance of lithium-ion batteries as manufacturing capacities surge despite limited demand,” See noted.

However, there is a possibility that customers seeking stationary power solutions might acquire spent EV batteries at considerable discounts, he said. “These customers could be the actual beneficiaries, assuming those batteries remain functional, rather than the manufacturers,” he noted. Indeed, Duke Energy’s Sowder is somewhat optimistic but remains uncertain whether repurposed Volt batteries will actually lead to cost savings.

Recycling EV batteries presents a challenge, as they are quite difficult to process, yet components like nickel and cobalt have enough value to justify the investment.

Across the globe, millions of electric vehicles are being sold that contain large lithium-ion batteries. For reasons related to both safety and sustainability, these batteries need to be recycled or disposed of properly when the vehicles reach the end of their lifespan.

Elsa Olivetti, the Jerry McAfee (1940) Professor of Engineering in the Materials Science and Engineering Department and co-director of the MIT Climate and Sustainability Consortium, asserts that, similar to all recycling efforts, the viability of the EV battery recycling market will be influenced by the profitability of salvaging specific materials. In the case of lithium-ion batteries, she notes that the focus tends to be on metals such as nickel and cobalt, which are costly and often sourced from lower-income countries under troublesome circumstances.

Recovering nickel and cobalt from used batteries could lessen the requirement for newly mined materials, especially if recyclers succeed in their claims that over 95 percent of these metals can be reclaimed. Nonetheless, as the world shifts from gasoline-powered vehicles to electric ones, the demand for these materials is expected to exceed the supply from recycling, indicating that mining for metals like cobalt will still be essential.

An EV battery consists of much more than just nickel and cobalt; it includes a mix of plastics, copper, aluminum, and other materials, some of which will not be fully recovered as they lack sufficient value. The materials that cannot be recycled need to be disposed of in landfills or, if classified as hazardous, must be securely stored.

To initiate the recycling process, EV batteries must first be dismantled, which is not a straightforward task due to the lack of standardization among batteries. Packs from companies like Tesla, BMW, and Nissan vary in size and contain differently shaped cells that are bonded together by welds and other connections requiring breakdown.

This variety adds complexity and increases the cost and hazards associated with the process. “The primary challenge in battery recycling lies in the differences in chemistry and form factor, alongside the necessary precautions to discharge them once recovered,” Olivetti stated. This is especially crucial because old or damaged lithium-ion batteries pose a fire risk, which complicates the safe accumulation of these batteries before disposal.

Once the old batteries are disassembled, various methods can be used for recycling the materials. “Pyrometallurgical” techniques expose the materials to extremely high temperatures in a furnace to reclaim some of the metals involved. “Hydrometallurgical” techniques involve using chemical solutions dissolved in water to extract the desired metals from the battery components. Both techniques have drawbacks: pyrometallurgical recycling consumes a significant amount of energy, while hydrometallurgical recycling necessitates further breakdown of the components beforehand.

It’s likely that numerous electric vehicle batteries will be repurposed rather than being recycled. An older EV battery may not be suitable for long-range travel but could still possess adequate storage capacity for a different application. For instance, Olivetti suggests that clusters of old batteries could help alleviate pressure on the power grid by supplying backup energy when necessary. In 2018, Nissan tested this concept by utilizing both new and used batteries from their Leaf EV model to power the Ajax Amsterdam soccer stadium.

“However, we need to ensure we accurately assess the battery’s health,” remarks Olivetti. “And that poses a challenge.”