An executive from BYD (002594.SZ) announced on Wednesday that the Chinese automaker has set targets for price reductions from suppliers for large-scale purchases, although these are subject to negotiation and are not obligatory.

The remarks from Li Yunfei, general manager of the Brand and Public Relations Department, were made on his Weibo account following reports that BYD had requested a supplier to lower prices by 10%.

He explained that annual price discussions with suppliers are a standard practice in the industry.

A widely circulated screenshot of an email from BYD to a supplier requested a 10% price reduction effective January 1, which was reported by various outlets, including Phoenix Finance.

Li did not mention the email in his comments.

Reuters was unable to authenticate the email, which was dated November 26, and BYD did not provide an immediate comment when contacted.

BYD is urging several suppliers to decrease their product prices starting next year, suggesting that price competition within China’s new energy vehicle (NEV) sector may continue.

According to a report from local media outlet Sina Tech, BYD is asking its suppliers of passenger car products to reduce their prices by 10 percent beginning January 1, 2025, referencing an internal email.

The company anticipates heightened competition in the NEV market in 2025 and believes that improving the competitiveness of its passenger cars requires collective cost-cutting across the entire supply chain, the report said, citing the email.

The corporation expects suppliers to seek areas to reduce costs and present their reduced bids by December 15, according to the report.

When asked to validate the email’s authenticity, BYD informed Sina Tech that it is currently in the process of confirming it.

Li Yunfei, BYD’s branding and public relations general manager, later stated on Weibo that negotiating prices with suppliers annually is a customary aspect of the automobile industry.

“We propose a price reduction target to suppliers based on economies of scale in mass purchasing. This is not compulsory, and negotiations can take place to move forward,” Li wrote.

He did not provide additional details, including whether BYD requested a 10 percent price cut from suppliers.

Screenshots of the email have begun circulating on Chinese social media platforms, indicating that BYD sold over 3.25 million units from January to October and is expected to surpass 4.2 million units for the entire year.

According to the email, BYD’s ongoing sales achievements can be attributed to technological advancements, scale benefits, and a cost-effective supply chain.

An industry source cited by Tencent News noted that BYD’s negotiating leverage with its supply chain grows as its sales rise from 2023.

The company frequently asks suppliers for price reductions, typically seeking cuts of 10 to 20 percent each year, this source mentioned.

Due to BYD’s substantial purchasing volumes, suppliers are compelled to comply unless they possess significant leverage or if the automaker cannot find an alternative, according to the source.

In the automotive sector, this scenario is typical, and suppliers can only strive to attract as many customers as possible to mitigate risks, the source stated.

BYD recorded sales of 502,657 NEVs in October, surpassing the 500,000 unit mark for the first time and marking the fifth consecutive month of record high sales, as per data released on November 1.

During the January to October period, BYD sold 3,250,532 NEVs, which is a year-on-year increase of 36.49 percent.

If BYD’s sales in November and December remain close to October’s figures, full-year sales may reach approximately 4.3 million vehicles, reflecting a 42 percent increase from 3.02 million in 2023.

From August to October, BYD expanded its production capacity by nearly 200,000 units, as stated by the company’s executive vice president, He Zhiqi, on November 2 via Weibo.

He did not specify details, but the increase of nearly 200,000 units is likely monthly capacity. BYD’s monthly sales rose from roughly 370,000 units in August to 500,000 units in October.

BYD’s recent actions indicate that intense price competition in China’s NEV industry is expected to persist into next year.

Prior to this, Tesla announced on November 25 that customers in China who order two more affordable variants of the Model Y before December 31 can receive a discount of RMB 10,000 yuan ($1,380) when completing their final payment.

Additionally, Tesla in China has extended its five-year, 0 percent interest financing incentive, which applies to all variants of the Model 3 and Model Y, until December 31, as stated on its Chinese website.

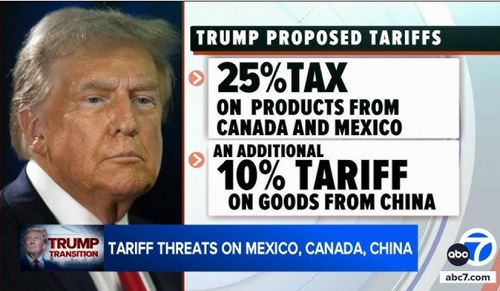

President-elect Donald Trump’s “America First” policy, which aims to implement significant tariffs on foreign goods, poses a risk of increasing costs and hindering the advancement of U.S. cleantech initiatives.

During his campaign, Trump vowed to introduce tariffs ranging from 10% to 20% on all foreign products, along with 60% to 100% tariffs on Chinese imports and 25% to 100% tariffs on Mexican goods—partially to deter Chinese companies from establishing manufacturing facilities in Mexico and partly to compel Mexico to curb migration to the U.S.

These measures could substantially inflate the expenses that U.S. businesses—and consequently consumers—face for items like batteries and electric vehicles, as well as for steel necessary for constructing solar farms, geothermal plants, nuclear power plants, transmission lines, and other infrastructures.

David Victor, a public policy professor at UC San Diego, remarks, “This will increase the cost of clean energy, which will impede the revolution,” referring to the generally quickening progression of low-emission industries.

Trump’s campaign declarations have not always been reflected in actual policies. However, he has consistently maintained that tariffs will encourage companies to manufacture more goods domestically, thereby revitalizing U.S. manufacturing, generating jobs, and reducing the federal deficit—while causing economic hardship for international competitors like China.

At a rally in Flint, Michigan, in September, Trump stated, “Tariffs are the greatest thing ever invented.”

Despite Trump’s assertions or comprehension regarding tariffs, they effectively act as a domestic tax imposed on U.S. businesses that acquire those goods, with the costs being passed to American consumers through higher prices. (Many Republicans concur with this perspective.) Numerous economists and international relations specialists suggest that such trade limitations should be approached cautiously, if not avoided altogether, as they can elevate inflation, provoke retaliatory trade actions, dampen investment, and obstruct broader economic growth.

The specific effects of Trump’s suggested tariffs on different sectors will depend on how high the incoming administration ultimately sets those rates, how they compare to existing tariffs, where else those goods can be procured, how companies and nations react over time, and what additional policies the administration implements.

However, here are three areas where the costs of essential materials and products crucial to the energy transition could increase under the plans Trump outlined during his campaign.

Batteries

China stands as one of the largest global producers of electric vehicles, batteries, solar cells, and steel; yet, largely due to preceding trade restrictions, the U.S. does not significantly depend on China for most of these products (at least directly).

Antoine Vagneur-Jones, who leads trade and supply chains at BloombergNEF, a market research firm, points out, “But there’s one exception to that, and it’s batteries.”

China has a commanding lead in the battery industry. A 2022 report by the International Energy Agency revealed that the country manufactures around 85% of the world’s battery anodes, 70% of its cathodes, and 75% of its battery cells. Furthermore, more than half of the international processing of key minerals like lithium, cobalt, and graphite, essential components for producing lithium-ion batteries, occurs in China.

According to BloombergNEF, the U.S. imported roughly $4 billion worth of lithium-ion batteries from China within the first four months of this year.

The U.S. currently has several tariffs on Chinese products, with President Biden retaining many of the tariffs that Trump applied during his first term, and even augmenting some earlier this year. The White House stated this was in response to what it described as “unfair trade practices” by China. However, it was just the latest step in a long-standing, bipartisan effort to counteract China’s escalating economic power and control over vital components in high-tech and cleantech segments.

Nonetheless, Trump’s proposed 60% to 100% tariffs would significantly surpass the existing tariffs on batteries, which are currently set at 28.4% for electric vehicle batteries. On a $4 billion transaction, those border tariffs could equate to an additional $2.4 billion at the lower end, more than doubling the extra cost under the current tariff rate, or (as might be expected) $4 billion at the higher end, assuming all else remains constant.

Vagneur-Jones observes that even with a 60% tariff, Chinese batteries are so cost-effective that they would still be competitive with U.S.-made alternatives. However, this would still lead to a considerable increase in costs for companies needing to purchase batteries for electric vehicles, residential solar systems, or grid storage facilities. Given China’s dominance in production, U.S. companies would have limited options to acquire those batteries from alternative suppliers at similar volumes.

Steel

Steel plays a crucial role in nearly every cleantech or climate-tech project today. It is strong and durable, forming essential components in wind turbines, hydropower facilities, and solar farms. All this steel must be sourced from somewhere, and for the most part, that source is not the U.S.

Last year, the US brought in 3.8 million tons of “steel mill products” from Mexico, valued at $4.2 billion, as reported by the International Trade Administration’s Global Steel Trade Monitor.

Steel imported into the US from Mexico, which is the country’s second-largest provider of the metal, typically does not face significant tariffs, provided it was initially melted and poured in Mexico, Canada, or the United States. Therefore, a 25% to 100% tariff on the same amount of steel could cost US companies an additional $1.1 billion to $4.2 billion (assuming all other factors remain unchanged and not including fees on certain steel products).

Earlier this year, the Biden administration imposed a 25% tariff on steel imports from Mexico that were melted and poured in other countries, as part of efforts to prevent major suppliers like China from avoiding tariffs. However, these taxes affect only a minor portion of the shipments.

Meanwhile, Trump’s 10% to 20% tariffs on imports from all countries could similarly increase costs for steel sourced from other nations globally, depending on how those tariffs compare to existing rates for each nation. For instance, this might add up to $1.6 billion to the nearly $8 billion worth of steel imported from Canada last year, the country’s largest supplier (assuming all else is equal and without considering fees on specific steel products).

These fees would raise the expenses for any US business that relies on steel not sourced from domestic suppliers, including cleantech firms working on demonstration projects or large-scale facilities.

However, many projects will be exempt from these costs. Those receiving various federal loans, grants, or tax benefits are generally already obligated to buy their steel from the US, meaning they would not be impacted by such tariffs, as explained by Derrick Flakoll, a North America policy associate at BloombergNEF, in an email.

Nevertheless, competition for limited supplies of domestic steel is expected to intensify. The US was a leader in global steel production for much of the last century, but it has now fallen to a distant fourth place, producing around one-twelfth of what China produced in the previous year, according to the World Steel Association.

“We pursued globalization,” remarks Joshua Posamentier, co-founder and managing partner of Congruent Ventures, a climate-focused venture firm based in San Francisco. “We now find ourselves completely reliant on other parts of the world.”

Electric vehicles

The US stands as the largest importer of electric vehicles (EVs), spending nearly $44 billion on battery, hybrid, and plug-in hybrid cars and trucks last year, as stated by the World Trade Organization. It has become the primary export market for Germany and South Korea, according to BloombergNEF.

If Trump were to impose a 10% to 20% tariff on all foreign goods, it would result in an additional cost of between $4.4 billion and $8.8 billion for the same volume of EV imports (assuming all factors remain unchanged and not adjusting for existing nation-specific fees).

His proposed higher tariffs on Mexican imports would significantly increase costs for vehicles manufactured in that country, which exported more than 100,000 EVs produced by major companies like Ford and Chevrolet last year, according to the Mexican Automotive Industry Association. Additionally, BMW, Tesla, and Chinese firms BYD and Jetour have all announced plans to manufacture EVs in Mexico.

While China is the foremost producer of EVs globally, Trump’s intention to impose a 60% to 100% tariff on Chinese goods is not likely to have a substantial effect on that market segment. This is largely because the US currently imports very few EVs from China. Furthermore, President Biden has recently increased the tariff rate to 100%.

The overall effects on the EV market may also be complicated by the incoming Trump administration’s reported plans to reverse federal regulations and subsidies supporting the industry, including certain aspects of the Inflation Reduction Act.

Repealing important features of Biden’s flagship climate legislation would undermine efforts to combat China’s dominance, as these federal incentives have already spurred a development surge in US-based battery and EV manufacturing projects, says Albert Gore, executive director of the Zero Emission Transportation Association.

“It would hinder a significant amount of investment in manufacturing across the United States,” he states.

The ‘big concern’

When applied effectively, tariffs can benefit specific domestic industries by allowing companies to compete against lower-cost international producers, catch up on manufacturing advancements or product enhancements, and address unfair trade practices.

Some US cleantech firms and trade organizations, including solar manufacturers such as First Solar and Swift Solar, have advocated for stricter trade limitations.

Earlier this year, those companies and others represented by the American Alliance for Solar Manufacturing Trade Committee requested the federal government to investigate “potentially illegal trade practices” in Cambodia, Malaysia, and Vietnam. They claimed that China and companies based in China are circumventing trade restrictions by exporting goods.