About BYD

BYD was established in February 1995 and is dedicated to utilizing technological innovations for the betterment of society. Over the course of more than 27 years, BYD has developed over 30 industrial parks across 6 continents, contributing significantly to the electronics, automotive, renewable energy, and rail transit industries. Focusing on energy acquisition, storage, and application, BYD provides comprehensive new energy solutions with zero emissions.

Build Your Dream (BYD) Company Limited, founded by Wang Chuanfu in 1995 and headquartered in Shenzhen, Guangdong, China, is a technology and manufacturing company. BYD is committed to technological innovation for improving the quality of life. The company has established over 30 industrial parks globally and played a vital role in the electronics, automotive, new energy, and rail transit sectors.

As a global leader in New Energy Solutions, BYD is devoted to creating a zero-emission environment. Since its inception, BYD has been highly dedicated to establishing a zero-emission ecosystem by developing cutting-edge environmentally friendly technologies. This reflects BYD’s commitment to a sustainable future through electrification, with the aspiration to achieve clean air for future generations. Alongside vehicles, BYD also offers solar panels or solar power, which is poised to become a primary energy source for cities in the future, facilitating smoother operation of urban ecosystems.

BYD’s four primary products are electric vehicle (EV) cars, Rail Transit, various electronic devices, and New Energy Solutions or Renewable Energy. Broadly speaking, BYD is already present in 400 cities, across 70 countries, and on 6 continents. In 2022, BYD globally sold nearly 1,860,000 new energy passenger vehicles. BYD has been actively involved in the electrification of urban public transportation to reduce global greenhouse gas emissions, with the vision of “Cooling the Earth By 1°C”. As of April 19, 2022, BYD has prevented 10,756,330,036 kg of carbon emissions, equivalent to planting about 896,360,836 trees.

Chinese car manufacturers are looking to Nvidia for advanced technology to compensate for their current lack of global brand recognition.

Chinese electric vehicle manufacturer BYD plans to utilize the upcoming generation of chips from US chipmaker Nvidia to enable heightened levels of autonomous driving and other digital functionalities in its vehicles.

Nvidia’s in-vehicle chips, named Drive Thor, are designed for generative artificial intelligence applications and have the capability to power a wide range of automotive products, including new energy vehicles, robotaxis, and robobuses, as stated in a press release by Nvidia.

Nvidia’s Vice President for Automotive, Danny Shapiro, mentioned in a conference call that “Drive Thor is being integrated into BYD [vehicles] next year.”

Alongside the Drive Thor chips, BYD also intends to leverage Nvidia technology for optimizing its manufacturing facilities and supply chain and to develop virtual showrooms, as per Shapiro.

The chipmaker, previously under scrutiny from Washington for its shipments of AI chips to China, has announced its plans to expand collaborations with other Chinese automakers, including Xpeng and GAC Aion’s Hyper.

Zeekr, a unit of Geely, and Li Auto had previously announced their intention to utilize Nvidia’s Drive Thor technology.

Shapiro highlighted that “There’s a massive number of Chinese automakers. They have a lot of incentives in place to innovate, a lot of regulation that’s favorable” for developing increased levels of automated driving.

Chinese carmakers are in a race to develop self-driving vehicles and AI-augmented infotainment technology in order to compete in global markets, with many of them turning to Nvidia for advanced technology to compensate for their current lack of global brand recognition.

For BYD, the collaboration with Nvidia comes at a crucial time due to its expansion efforts in foreign markets such as Europe, Southeast Asia, and Mexico.

Having surpassed Tesla as the world’s largest electric vehicle manufacturer late last year, BYD will be competing with Tesla in these markets and facing tough competition from established Western vehicle brands in their home market.

However, a major challenge for BYD will be the increasing regulatory scrutiny in the West. American and European authorities are becoming more cautious about the competitive threat posed by affordably priced Chinese electric vehicles and the national security risks associated with the data-collecting sensors and chips powering them.

BYD plans to invest US$14 billion to develop smart cars, as it anticipates intelligent new energy vehicles to be the next battleground for the industry, according to founder and CEO Wang Chuanfu.

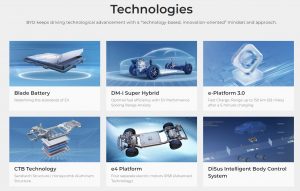

The system includes a variety of technologies developed by BYD for vehicle intelligence and electrification. This includes cloud-based artificial intelligence, 5G network connectivity, smart driving, and smart cockpit features, allowing a car to adapt to changes in the internal and external environment in real time for improved driving safety and comfort.

“The first half of the game is about electrification, and the second half is about intelligence,” Wang stated, without specifying a time frame or further details regarding the innovations expected from the 100 billion yuan investment.

Shenzhen-based BYD, which overtook Tesla to become the leading manufacturer of pure battery-powered electric vehicles in the fourth quarter of last year, is now focusing on intelligent vehicles to compete with rivals in areas such as autonomous driving and voice recognition.

The company employs over 90,000 individuals, with around 4,000 dedicated to smart driving. Among these are 1,000 algorithm and hardware engineers and 3,000 software engineers, according to Wang.

Last April, BYD launched its DiSus intelligent vehicle body control system, enabling its cars to perform spinning maneuvers and crabwalk. Initially available on its luxury model Yangwang U8, DiSus is the first self-developed intelligent body control system introduced by a Chinese automaker and will serve as the foundation for BYD’s future development of its advanced driver assistance system, as per Wang.

In China, electric vehicles with the latest digital technologies have become popular among young drivers who prioritize autonomous driving systems and digital cockpits when selecting new cars.

Intelligence in cars is assessed based on digital features such as voice-activated controls, facial recognition, over-the-air software updates, phone compatibility, and self-parking.

“Almost all major Chinese EV manufacturers are bolstering their research and development teams to enhance the intelligence of their vehicles in terms of self-driving and in-car entertainment,” remarked Cao Hua, a partner at Shanghai-based private equity firm Unity Asset Management, which has investments in artificial intelligence (AI) and vehicle robots.

“Known for its high-quality batteries, BYD is striving to catch up with domestic competitors like Nio and Xpeng by making substantial investments in intelligence to sustain its sales growth momentum.”

Xpeng, headquartered in Guangzhou and recognized for its advanced driver assistance system, intends to expand the utilization of its self-driving technology across the country by the end of this year, according to co-founder and CEO He Xiaopeng.

In September last year, Shanghai-based Nio introduced the company’s first smartphone designed specifically as a companion device for its EVs. It offers over 30 car-specific features, including initiating self-parking mode, unlocking the car with a press of a button even when the smartphone is powered off, and transitioning a video call from the phone to the car’s screen and speakers.

Huawei, a telecommunications and smartphone manufacturer and potential rival to BYD, invited at least four traditional automakers to join its new smart car joint venture, launched with state-owned Changan Automobile, in November.

BYD reports that there are already more than 2.6 million of its cars equipped with L2 autonomous driving systems. According to the global standardization body SAE, L2 systems provide assistance to the driver but require active supervision.

In 2023, over 57% of the vehicles sold by BYD were equipped with smart driving systems, and the company anticipates increasing this percentage further this year.

Last year, BYD sold over 3 million new energy vehicles, including pure EVs and plug-in hybrids, representing a 60% year-on-year increase, as per Wang.

This year, BYD plans to launch over 10 high-end smart driving models equipped with lidar (light detection and ranging) sensors, according to Wang. Models priced above 200,000 yuan will offer high-end intelligent driving assistance systems as an option, while it will be standard in models priced above 300,000 yuan, he added.

“The deployment of urban NOA [navigation on autopilot] by more and more automobile companies indicates that the trend of car intelligence is becoming increasingly evident,” commented Zhou Xuhui, an analyst at Eastmoney Securities, in a report on Tuesday.

“We believe that ‘intelligence’ will become an important criterion for measuring the core competitiveness of car companies in the future.”

According to two individuals familiar with the matter, BYD has backed out of a deal to incorporate Baidu’s autonomous driving technology into its electric vehicles. This decision reflects the world’s largest EV manufacturer’s aspiration to focus on in-house development of intelligent car software rather than using Baidu’s technology, including navigation and automated valet parking. The agreement, initially reached in March 2022, was considered a major accomplishment for Baidu’s Apollo autonomous driving unit, established in 2013 with the goal of perfecting autonomous driving, an area of focus for CEO Robin Li Yanhong.

In November 2022, Baidu announced during its third-quarter results that one of the major car manufacturers in China had plans to utilize the Apollo technology suite. This partnership was described as an indication of the growing interest from automakers in Baidu’s self-driving solutions. It was later revealed that BYD was the collaborating partner.

The termination of this agreement deals a significant setback to Baidu’s aspirations in the autonomous driving sector and reflects the challenges encountered by the Chinese self-driving industry in achieving fully autonomous driving.

Baidu and BYD did not respond immediately to requests for comments.

Despite the setback, Baidu remains committed to self-driving technology and continues to prioritize its development, as confirmed by an unnamed source who is an employee.

Another undisclosed source, citing the sensitive nature of the matter, stated that BYD has “halted” its collaboration with Baidu on autonomous driving technologies. This decision was attributed to the automaker’s perception that self-driving technology does not hold immediate promise for widespread adoption in the electric vehicle mass market.

However, Baidu currently operates the largest fleet of robotaxis in China among autonomous driving companies. It has been conducting trials and operations with over a hundred robotaxis in designated areas across several major Chinese cities. In March, the Beijing city government granted Baidu permission to operate ride-hailing services in the Yizhuang industrial zone without drivers or safety operators in the vehicles.

Despite these advancements, industry insiders and investors believe that large-scale robotaxi operations and autonomous trucks are far from achieving profitability due to technological limitations, regulatory constraints, and safety considerations.

An investor from venture fund Yunqi Partners, who declined to be named as they were not authorized to speak to the media, expressed reservations about robotaxis due to the high and seemingly unmanageable costs, emphasizing the impediments posed by the necessity for constant updates of high-resolution maps and stringent regulations for large-scale implementations.

In addition to lidars, sensors, and cameras, autonomous driving vehicles rely on high-resolution maps for navigation.

Amid China’s economic challenges and the shifting interests of tech investors towards emerging technologies like ChatGPT, the autonomous driving sector in China is striving to reduce costs by downsizing while simultaneously attempting to boost tech sales to car manufacturers within a highly competitive market.

According to Wang Naiyan, the chief technology officer of TuSimple China, a developer of autonomous trucks, this industry presents a challenging landscape for entry, requiring fierce competition between self-driving companies to secure orders for autonomous driving software solutions from automakers.

He further emphasized a forthcoming significant transformation within the market where “many firms will disappear.”

Chairman Wang Chuanfu of Chinese electric vehicle maker BYD announced plans to invest 100 billion yuan ($13.8 billion) in areas related to autonomous driving at a recent shareholders meeting. This decision reflects the increasing standardization of autonomous driving technology in more vehicles across China.

No specific timeline for these investments was provided, although the company’s research and development expenses for the fiscal year ending in December 2023 reached 39.5 billion yuan, marking a 2.1-fold increase from the previous year.

The Chinese market has witnessed a surge in the development of smart vehicles, including those capable of autonomous driving.

Electric vehicle startup XPeng Motors’ CEO He Xiaopeng declared that the upcoming decade will be characterized by advancements in intelligent technologies during a news conference in April. XPeng is leveraging artificial intelligence to develop vehicle operation and driver assistance technologies.

Major automakers have also initiated the incorporation of driver assistance technologies for use on highways and regular roads, as well as automatic parking technology.

Despite BYD’s success in boosting sales of affordable EVs and plug-in hybrids in the 100,000 to 200,000 yuan range, many of these models do not feature advanced driver assistance functions. In an effort to enhance functionality across a wide range of models, BYD reportedly employs 4,000 to 5,000 engineers specializing in autonomous driving.

During the recent shareholders meeting, Wang also expressed BYD’s willingness to make substantial investments in the field of AI if opportunities arise. The company intends to harness AI for in-vehicle functions and production lines.

Regarding the company’s brand strategy, he highlighted that the average unit price of a car in China stands at approximately 160,000 yuan, a segment on which BYD is concentrating. Furthermore, the company aims to penetrate the upper end of the market with brands such as the luxury line Denza and Yangwang, which offers vehicles priced over 1 million yuan.

Acknowledging the intensifying competition in the new energy vehicle market, BYD disclosed a decision to reduce prices across all of its primary models in February, stressing the company’s commitment to sustainable sales rather than relying on short-term marketing tactics.

China has authorized a select group of nine automakers to conduct tests using vehicles equipped with advanced autonomous driving technologies on public roads. This forms part of a broader initiative to expedite the adoption of self-driving cars.

The industry ministry revealed that automakers like BYD and Nio, along with major state-owned manufacturers such as Changan Automobile, GAC, and SAIC, will conduct tests for level three autonomous driving technologies.

The tests will also involve fleet operators such as ride-hailing companies.

The auto industry has categorized autonomous driving into five levels, ranging from basic driver assistance features at level one to fully self-driving cars at level five.

In November last year, China issued guidelines for a nationwide scheme to start accepting applications from companies looking to introduce more fully autonomous driving vehicles for mass adoption.

According to the plan, drivers in the test vehicles are permitted to take their hands off the steering wheels, with automakers and fleet operators taking responsibility for safety.

The ministry mentioned that the trial would pave the way for the further commercialization of more advanced autonomous driving technologies, without providing further details. Executives from automakers noted that this was a step closer to allowing level three vehicles to be sold to individual buyers and fleet operators.

In China, at least 10 automakers and suppliers, including Huawei and Xpeng, are offering level two autonomous driving capabilities, which still require an attentive driver with hands on the wheel.

Reuters has reported that Tesla is preparing to deliver its “Full Self-Driving” (FSD) software to Chinese users within the year. Although FSD is a level-two system, Tesla CEO Elon Musk has stated that more fully autonomous vehicles are imminent.

Local media has reported that BYD has brought in a new senior executive, Zhou Peng, to accelerate the development of its driver assistance technology.

Zhou Peng, previously a technical architect at Baidu’s smart driving and fusion business unit, will be responsible for the development of end-to-end large model planning and control algorithms at BYD, as reported by local media outlet 36kr.

According to the report, “end-to-end intelligent driving” has become a clear industry consensus, and BYD is currently at the initial exploration stage of this technology.

To train end-to-end algorithms, a substantial amount of high-quality data is needed, requiring the development of an efficient technical framework and team, as stated in the report.

The report adds that having a leader with proven project experience is crucial to building the technical framework and leading the team and also mentioned Zhou’s previous roles at Baidu and GAC R&D Center.

Local media, citing a BYD insider, reported that BYD is aiming to enhance its self-driving capabilities using two approaches: benchmarking its in-house technology against Tesla and adopting vendor solutions to stay ahead of the curve and ensure safety.

BYD’s higher-level smart driving technology is currently featured in high-end products such as the Yangwang U8 and Denza N7. However, due to fierce competition, car makers, including BYD, are looking to incorporate such technology in lower-priced models.

The report mentioned that some variants of BYD’s Han and Song L currently come with high-level intelligent driving systems, and in the future, its Ocean and Dynasty series models priced at $27,500 will also feature a high-level intelligent driver assistance system, using a single Journey 5 chip-based solution from Horizon Robotics.

Although BYD has been relatively conservative in the smart driving space, it has intensified its efforts this year, notably launching the Xuanji Architecture on January 16 as the centerpiece of its vehicle intelligence.

During the January event, BYD’s chairman, Wang Chuanfu, mentioned that the company would invest a substantial amount in intelligence going forward to lead the way for NEVs. He did not specify the duration of these investments but pointed out that BYD has an intelligent driving team of over 4,000 people, with more than 3,000 being software engineers.

At the event, BYD also announced that in the future, its high-level intelligent driving system will come standard on models priced over $27,500, while models priced between $27,500 and a specified amount will offer it as an option.

Tesla (NASDAQ: TSLA) rolled out the FSD V12 earlier this year, which has yielded positive results. This has reinforced the growing industry consensus on the end-to-end large model technology used by Tesla, prompting more car companies in China to explore this approach.

A June 19 story reported that Nio’s smart driving R&D department underwent a team reshuffle to concentrate more on end-to-end technologies, recognized as superior solutions.

Li Auto recently assembled a team of over 200 people for developing large model autonomous driving technology, as reported by 36kr on July 17.

Once ridiculed by electric car magnate Elon Musk, BYD Co. Ltd. has emerged as the primary global rival to Tesla Inc., partly due to its expertise in creating automotive power cells required by Musk’s company.

The Chinese EV manufacturer now faces the challenge of matching the excitement that Musk has generated with driver assistance technology, also known as “smart driving,” which has become a crucial selling point in a crowded industry.

BYD was established in 1995 in Shenzhen, a booming city for electronics in southern China, primarily as a producer of handsets and laptop batteries. It transitioned into car production in 2003 after acquiring a small Chinese automaker in Xi’an, and then entered the new-energy vehicles (NEVs) segment five years later with the introduction of a plug-in hybrid named the F3DM, initially targeting government agencies and businesses.

In 2010, the company from Shenzhen introduced its first all-electric car, the e6. However, both models failed to attract local consumers at that time despite being offered at a premium price.

A significant turning point came in 2021, when BYD’s NEV sales surged over threefold, surpassing sales of gasoline-powered vehicles for the first time by a substantial margin. Selling 603,783 NEVs that year accounted for over 80% of its total auto sales. This success led the company to stop producing gasoline vehicles the following year. Record NEV sales of more than 3 million in 2023 validated this decision, with the company surpassing Tesla in the final quarter of the year to become the world’s largest manufacturer of fully-electric cars.

The company’s ability to design and produce NEV components has been a key factor in its ability to implement periodic price reductions…

BYD’s expertise in batteries has been crucial to its ascent as a leading NEV manufacturer, largely because control of its supply chain has allowed the company to offer lower prices than its competitors.

BYD has concentrated its research efforts on lithium iron phosphate (LFP) batteries. In March 2020, the company claimed a major technological achievement with the launch of the “blade battery,” which it stated is safer and more cost-effective than traditional cells as it does not utilize expensive cobalt, which is difficult to procure.

To effectively compete with BYD, several battery companies, including industry leader Contemporary Amperex Technology Co. Ltd., have hastened the introduction of their own LFP batteries to compete with the blade battery, laying an important foundation for wider adoption of NEVs, according to a battery industry insider who spoke to Caixin.

During the first half of this year, 69.3% of the total power batteries sold in China were LFP batteries designated for use in NEVs, equivalent to approximately 141 gigawatt-hours, according to data from the China Automotive Battery Innovation Alliance (CABIA).

During this period, BYD was the second-largest manufacturer of such batteries in China by installed capacity, with a market share of 35.8%, closing in on CATL, which held a 37.2% market share, as reported by CABIA.

Playing catch-up in smart driving

Although BYD chair and CEO Wang Chuanfu previously dismissed autonomous driving as a trend driven by capital, he now appears to have embraced it.

At a shareholder meeting on June 6, he announced that BYD would make significant investments in smart driving as artificial intelligence (AI) technology advances and disclosed that the company has formed a team of approximately 4,000 individuals dedicated to advanced assisted driving technology.

These statements followed BYD’s January announcement of a broader plan to transition to smart cars, part of a $14 billion investment in intelligent driving widely viewed as an effort to compete with Tesla, which has gained consumer attention with its rollout of driver assistance technology onto public roads.

BYD’s plan centers around its proprietary smart car architecture called Xuanji, which enables a vehicle to automatically adjust its movement based on internal and external data processed by what the company refers to as “the brain” and “the nervous system”.

The plan also encompasses an AI-powered multimodal model specifically designed for smart cars. Nonetheless, industry analysts point out that BYD lags behind competitors such as Tesla, software giant Huawei Technologies Co. Ltd., and EV upstart XPeng Inc. in the development of smart driving technology.

Caixin reported last month that Tesla has obtained a license from the Shanghai government that could allow the US automaker to test its Full Self-Driving (FSD) system in the Chinese financial hub. This move may give Tesla an advantage in the Chinese market as the government supports autonomous vehicles.

Musk’s push for Full Self-Driving (FSD) could be diverting attention from the company’s larger challenges in China. Tesla’s sales have dropped due to a local price war. In June, shipments from Tesla’s Shanghai factory decreased by 24.2% year-on-year to 71,007 units, as reported by the China Passenger Car Association. In comparison, BYD’s shipments increased by 35.2% to 340,211 units during the same period.